What is budgeting and why is it important? 7 expert tips to get started

With pressure on household finances, we explore why budgeting is so important - and how to get started

Amid the cost of living crisis, you may be wondering what is budgeting and why is it so important.

The cost of everything is high at the moment. Budgeting can help you to keep your finances healthy by ensuring you are on top of exactly what you are spending your money on. There are even budgeting apps you can use to help get started.

Laura Suter, head of personal finance at investment firm AJ Bell, says: “Budgeting is a great way for many people to reset their finances and spending patterns and to really assess where their money is going. There’s never a bad time to get started, but at the moment with extra pressures on household budgets with the rising cost of living, it’s a good idea for everyone, no matter what level of income they have.”

What is budgeting and why is it important?

Put simply, budgeting is a way of taking control of your money. You know what’s coming in, what’s going out, and have a plan in place to ensure you are living within your means. Some people like to budget weekly, others prefer monthly; it’s all down to what works for you. Budgeting is important because, without it, you could spend more than you earn and get into debt.

Having a budget plan in place improves your chances of staying on top of rising bills so that you keep your spending under control. A budget can also be a real help in achieving specific financial goals you might have too. This could be saving for a deposit for a house, a wedding, or simply paying off debts. It can be difficult to resist the temptation to spend money on treats, but it is much easier if you have something tangible that you’re saving towards.

What’s more, having a money plan in place can help you prepare for unexpected costs. These could be needing a new boiler or urgent repairs to your car. “Even if you don’t have anything special to save for, budgeting is still beneficial to give you a firmer grip on your money,” says Annabelle Williams from investment firm Nutmeg. “This will help with your financial well-being which will be a welcome benefit for most. Money can be a huge cause of stress, so getting on top of everything could help enormously.”

How can I save money by budgeting?

Budgeting can be extremely effective if you’re looking to save money. Keeping on top of not only how much you are spending, but where that money is going, can help you spot areas where savings can be made. By simply being aware of every item that goes out each month, you will naturally become more conscious of spending on things you don’t need, or bills where you might be paying too much. For example, budgeting might help you recognise that you’re spending a lot on your broadband, and push you to shop around for a new package.

GoodtoKnow Newsletter

Parenting advice, hot topics, best buys and family finance tips delivered straight to your inbox.

How can I get started budgeting?

Your first port of call is to find out where your money is going each month. Personal finance expert Laura Suter told us: “It’s pointless setting a budget if it bears no resemblance to what you’re spending currently or if you’ve forgotten to account for entire areas of spending.”

Once you’re clear about how you are spending money, you can look to make cuts on unnecessary outgoings. It’s not uncommon to find you’ve signed up to a free trial or subscription that is no longer used. Or maybe you have failed to notice that the cost of something has crept up and it no longer offers good value.

When it comes to setting a budget, make sure you account for things such as birthday presents for loved ones, or any holidays you take each year, as well as regular outgoings. If you forget to account for these you could end up feeling bad – and stretched - when you have to fork out the extra money in one month. If you want to go a step further you could save monthly for the bigger annual expenses, such as Christmas or a holiday to spread the cost.

Setting limits on spending is a fine balancing act, however. By going too far, you’ll likely fail to hit your targets which can be dispiriting. However, setting it too high means you could end up spending more than you need.

Laura adds: “An important step in this process is telling people that you’re trying to budget and that you want to save money. You’ll feel more accountable if you tell people your plans, that will help you stay on track. But it also means that it will be easier to explain why you can’t afford a big night out or a spendy weekend away if your friends are already aware you’re trying to save cash.”

Top tips for budgeting

- Set aside enough time to go through all your outgoings so you know exactly what you’re spending.

- Set realistic budgets. There’s no point in leaving yourself so short that you bust the budget in the first week.

- Take into account big-spending - such as birthdays, holidays - and spread the costs if you can

- Keep receipts all in one pile for the week. If you use your smartphone, check the list of items paid for.

- Consider using cash if you think it will stop you overspending. After all, tapping your card to pay is all too easy.

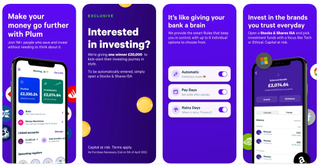

- Use a budgeting app that will allow you to check your spending on the go. We recommend Plum, as highlighted below.

- Tell friends and family you’re on a strict money diet so they can support you.

How much time does budgeting take?

There’s no sugar-coating it - setting yourself and sticking to a budget isn’t a five-minute job. You’ll need to set aside some time to gather everything you need from your statements and bills. Then you’ll need to go through everything to see where savings can be made. Only then can you come up with your spending plan. You may not finish everything in one sitting, but a few hours spent fine-tuning your finances is well worth your time.

Budgeting isn’t a one-off either. You’ll need to then devote some time to tracking your spending and dealing with any changes. For example, your broadband deal might be coming to an end, meaning that your bill is about to rise. Putting aside time to find a better package can keep your finances on track.

Video of the Week

-

New data highlights the main disparities when it comes to parents requesting flexible working, and sadly we're not surprised by the findings

New data highlights the main disparities when it comes to parents requesting flexible working, and sadly we're not surprised by the findingsWe'll give you three guesses as to which parent is more likely to ask for flexible working arrangements from their employer...

By Sarah Handley Published

-

Who did Bluey have a baby with? Fan theories are running wild following the cartoon’s season 3 finale (our money is on Mackenzie)

Who did Bluey have a baby with? Fan theories are running wild following the cartoon’s season 3 finale (our money is on Mackenzie)The 'Surprise!’ episode has really done what it says on the tin - and many can’t get over the shock of Bluey having a baby

By Charlie Elizabeth Culverhouse Published

-

New data highlights the main disparities when it comes to parents requesting flexible working, and sadly we're not surprised by the findings

New data highlights the main disparities when it comes to parents requesting flexible working, and sadly we're not surprised by the findingsWe'll give you three guesses as to which parent is more likely to ask for flexible working arrangements from their employer...

By Sarah Handley Published

-

Record number of families opt-out of claiming child benefit, but the decision could have serious repercussions for your future

Record number of families opt-out of claiming child benefit, but the decision could have serious repercussions for your futureStark warning for families as number of parents who opt-out of receiving child benefit reaches 10-year high

By Sarah Handley Published

-

'It isn’t a holiday – it is crucial bonding time' - 70% of dads can't afford to take two weeks paternity leave, according to new research

'It isn’t a holiday – it is crucial bonding time' - 70% of dads can't afford to take two weeks paternity leave, according to new researchThe research also found that only 14 per cent of fathers were ready to return to work mentally after taking their paternity leave

By Sarah Handley Published

-

Two-child benefit cap 'pushes children into poverty' - campaigners urge government to scrap 'cruel policy' that impacts 1 in every 10 children

Two-child benefit cap 'pushes children into poverty' - campaigners urge government to scrap 'cruel policy' that impacts 1 in every 10 childrenThe controversial two-child benefit cap has met with strong opposition since its introduction in 2017

By Sarah Handley Published

-

Gen-Z could be costing their parents £1,300 a year, by refusing to do this one thing (but it's not always their choice)

Gen-Z could be costing their parents £1,300 a year, by refusing to do this one thing (but it's not always their choice)It's not just parents who are facing the additional costs, the costs for Gen Z could be even higher

By Sarah Handley Published

-

More than half of parents want to do this important thing for their kid's education but can’t afford to, according to new research

More than half of parents want to do this important thing for their kid's education but can’t afford to, according to new researchPressures on the family budget are preventing parents from paying for educational support outside of school

By Sarah Handley Published

-

75% of mums feel guilty buying things if they earn less than their partners, according to social media poll, and the comments section was part heartbreaking, part inspiring

75% of mums feel guilty buying things if they earn less than their partners, according to social media poll, and the comments section was part heartbreaking, part inspiringSome mothers felt guilty for spending their partners money, while others saw it as household money instead

By Sarah Handley Published

-

10 best zoos in the UK based on ticket prices, reviews and value for money

10 best zoos in the UK based on ticket prices, reviews and value for moneyThe best zoos in the UK have been determined based on a number of key factors, include prices, popularity, Trip Advisor ratings and how many animals they have

By Sarah Handley Published