GoodtoKnow Newsletter

Parenting advice, hot topics, best buys and family finance tips delivered straight to your inbox.

Latest News

-

Millennial dads are doing 4 things better than previous generations, but is it enough to lighten the mother's mental load?

Millennial dads are definitely doing better than their previous counterparts, but there's still areas they can improve on their parenting to be truly equal to their partners.

By Lucy Wigley Published

-

Psychologist explains how 'eggshell parenting' is an 'unsafe' strategy leading to lifelong damage to kids - these are the 9 signs to look out for

Eggshell parenting is the latest term coined by a psychologist, and it's potentially very damaging. Find out everything you need to know about it, and what the expert is saying.

By Lucy Wigley Published

-

Want to up your grandparenting game? These are the 6 phrases to avoid saying, according to experts

“It’s never too late to start being more mindful of how you approach interactions with your grandchildren”

By Charlie Elizabeth Culverhouse Published

-

Princess Charlotte would have meant ‘everything’ to late grandmother Princess Diana, reveals former royal butler

Despite never getting the chance to meet her, Princess Charlotte has so much in common with her late grandmother

By Charlie Elizabeth Culverhouse Published

-

What is chroming? The dangerous viral trend explained, plus how to talk to kids about it

Concerned parents want to know what chroming is, after the dangerous trend has been linked to deaths.

By Ellie Hutchings Published

-

Reframing one simple habit could get your sex life back on track after having a baby, new research shows

Many parents struggle to get their sex life back on track after having a baby, but new research has shown how one simple habit could make all the difference.

By Ellie Hutchings Published

-

Child psychologist unveils 'the grandparent code', a list of 12 grandparenting rules to keep family relationships strong and healthy

Some are common sense, others may be a little harder to follow...

By Charlie Elizabeth Culverhouse Published

-

Raising an anxious kid? Here are 6 things that mental health experts want parents to know (and #1 could be a game changer)

If you have a child who often experiences feelings of anxiety, psychologists have explained some ways you can respond when they're struggling with their emotions.

By Ellie Hutchings Published

-

Prince William and Kate Middleton planning to renovate family home as it only ‘just about fits the entire family’

The Waleses Windsor home Adelaide Cottage is about to get a new look

By Charlie Elizabeth Culverhouse Published

MEET THE TEAM

Latest Family

-

When is the next train strike? April 2024 dates

Here’s everything we know about when the next train strike will be

By Ellie Hutchings Last updated

-

How to relieve pregnancy constipation at home, according to doctors

Knowing how to relieve pregnancy constipation, and understanding the causes, can help you manage this condition effectively at home, ensuring both comfort and health during pregnancy.

By Rachael Martin Last updated

-

Internationally renowned experts in endometriosis and consultant gynaecologists answer questions on endometriosis and pregnancy

Doctors answer common questions about endometriosis and pregnancy, fertility, and options for getting pregnant with endometriosis.

By Rachael Martin Last updated

-

When do you find out about primary school places for 2024? How to find out what school your child got into and what to do if you're not happy with the choice

We've shared when find out about primary school places for 2024 how to appeal a decision you're unhappy with.

By Stephanie Lowe Last updated

-

Does your child have a balanced play diet? Research psychologist reveals what this is and why your kid might need one

It's not all fun and games - play is a crucial part of childhood....

By Dr Amanda Gummer Published

-

Holidays with teenagers: 6 of the best holiday ideas for families with teens

Desperate for ideas for holidays with teenagers? We've asked the experts for the top options

By Ellie Hutchings Last updated

Where to buy

-

What is a travel system? Baby gear experts explain how they work - and what’s included

Experts decode what is a travel system and offer tips on how to find the best one for you

By Charlotte Duck Published

-

36 best gifts for new mums 2024 - thoughtful ideas for parents and mums-to-be

Best gifts for new mums, according to parents, from lip balm to leak-proof bottles and eye masks to food deliveries

By Stephanie Lowe Last updated

-

Magic Mixies Pixlings are a bestseller - but are they worth the money? We put this toy through its paces to find out

Magic by name and magic by nature? We review Magic Mixies Pixlings to see if it lives up to the hype

By Sarah Handley Published

-

I tested the Lakeland Dual Basket air fryer and it made midweek family cooking a breeze

You can’t go wrong with the dual basket air fryer by Lakeland complete with easy-view windows to ensure burnt food is a thing of the past…

By Jessica Dady Published

-

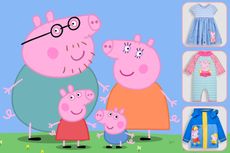

This brand new Peppa Pig clothing collection is perfect for summer holidays (and prices start from just £15)

Perfect for little Peppa fans, this new clothing collection is just the thing for summer fun with their favourite character

By Sarah Handley Published

-

Best toys for 6 year olds 2024: 45 age-appropriate gift ideas from just £6.99

From Barbie to slime, and from educational to creative, these top toys for six-year-olds are sure to be a big hit

By Sarah Handley Last updated

More from GoodtoKnow

Latest money

-

'It isn’t a holiday – it is crucial bonding time' - 70% of dads can't afford to take two weeks paternity leave, according to new research

The research also found that only 14 per cent of fathers were ready to return to work mentally after taking their paternity leave

By Sarah Handley Published

-

Two-child benefit cap 'pushes children into poverty' - campaigners urge government to scrap 'cruel policy' that impacts 1 in every 10 children

The controversial two-child benefit cap has met with strong opposition since its introduction in 2017

By Sarah Handley Published

-

What is child benefit, am I eligible and how much could I get? New rates for 2024 explained

We explain what child benefit is, who can and should claim it and how much you will get, as well as how claiming it can help boost your state pension

By Sue Hayward Last updated

-

Gen-Z could be costing their parents £1,300 a year, by refusing to do this one thing (but it's not always their choice)

It's not just parents who are facing the additional costs, the costs for Gen Z could be even higher

By Sarah Handley Published

-

More than half of parents want to do this important thing for their kid's education but can’t afford to, according to new research

Pressures on the family budget are preventing parents from paying for educational support outside of school

By Sarah Handley Published

-

Does everyone get 15 hours free childcare now the scheme is being expanded? Here's everything you need to know

With various schemes available to help with costs, does everyone get 15 hours free childcare a week?

By Emma Lunn Last updated

Latest wellbeing

-

12 best mood-boosting perfumes for an immediate scent escape

From relaxing notes to energising scents, these mood-boosting perfumes will invigorate your senses

By Annie Milroy Published

-

Reframing one simple habit could get your sex life back on track after having a baby, new research shows

Many parents struggle to get their sex life back on track after having a baby, but new research has shown how one simple habit could make all the difference.

By Ellie Hutchings Published

-

Raising an anxious kid? Here are 6 things that mental health experts want parents to know (and #1 could be a game changer)

If you have a child who often experiences feelings of anxiety, psychologists have explained some ways you can respond when they're struggling with their emotions.

By Ellie Hutchings Published

-

This daily habit all couples do could be killing your relationship, says expert - but the advice has proved to be controversial

An expert has warned that one common pastime could be ruining your relationship, calling it the 'lowest form of intimacy'. But not everyone is convinced...

By Ellie Hutchings Published

-

Trans children are being 'let down by NHS' amid gender identity debate, major review finds

A new review has found that the debate around trans issues has led to children unsure of their gender identity being 'let down' by the NHS.

By Ellie Hutchings Published

-

This popular genre of TV could be harming your love life, says study - and here's the surprising reason why

Fans of Friends and How I Met Your Mother might want to consider introducing some more romantic TV shows onto their watch list...

By Ellie Hutchings Published

Latest food

-

15 kid's birthday cupcakes you can easily make yourself (#8 certainly has the 'wow' factor)

These birthday cupcakes for kids are tasty, easy to make, and perfect for sharing come party time...

By Jessica Ransom Published

-

15 healthy fish recipes the kids will actually eat (including an Annabel Karmel classic)

From fish pies to crunchy tuna cakes and salmon pasta dishes to fish burgers, we've got lots of delicious and easy fish recipes for kids...

By Lara Kilner Last updated

-

Genius ways to use up leftover beef from Sunday's roast (#12 is a 20-minute wonder)

Here are the best ways to use up leftover beef including noodles, stews, pies and so much more...

By Lara Kilner Last updated

-

13 quick and easy instant noodle recipes every parent needs to know about

Speedy instant noodle recipes every parent needs in the midweek madness...

By Lara Kilner Last updated

-

24 of the best birthday cake ideas for Dad (#3 is perfect for Father's Day too)

Showstopping birthday cakes and Father's Day bakes for the Dad figure in your life...

By Lara Kilner Last updated

-

Biscuit cakes are the next best thing - and here's how to make them with the kids

Our biscuit cakes are perfect for making with kids and can be served at parties, picnics or simply for a weekend treat...

By Jessica Ransom Published

Recipe Finder

Most Popular

-

Mary Berry’s lemon drizzle cake

Learn how to make Mary Berry's lemon drizzle cake recipe our easy guide. Mary's classic lemon drizzle will never let you down - see how to make it here.

-

Basic cupcake

Make a batch of 24 cupcakes in just 40 minutes with this basic recipe. Ideal for bake sales, school fetes, kids' parties, and more.

-

Mary Berry’s chocolate cake

Make a perfectly rich chocolate cake with luxurious chocolate icing using Mary Berry's chocolate cake recipe...

-

Easy chocolate chip cookies

One of our most popular chocolate chip cookie recipes is ready in just 30 minutes...

-

Chocolate muffins

Soft, moist chocolate muffins with a rich chocolate sponge and dark chocolate chunks. This recipe makes 12 muffins...

-

Butterfly buns

Our easy butterfly buns recipe is perfect for kids. We've kept our butterfly cake recipe simple - just slice the tops off and fill with buttercream and jam...

Spotlight

-

70 things to do with kids and how to entertain them (we've found the best and cheapest activities to try)

Things to do with kids to keep them engaged and entertained

-

Things to do with toddlers at home: 48 easy ideas with cardboard, pegs and tweezers

Things to do with toddlers at home that won't break the bank or your will to live

-

Indoor activities for kids: 40 amazing ideas for rainy days

It's raining, it's pouring but luckily there's fun to be had!