Should you get a payday loan?

Payday lenders are often bashed for charging more than 6,000% annual interest - despite loans being charged for short periods of time.

Payday lenders are often bashed for charging more than 6,000% annual interest - despite loans being charged for short periods of time.

They are a high-interest loans that has been slammed for trapping people in debt.

What are payday loans?

Payday loans are designed as a last resort for those struggling with their next finances until the next payday.

But they come with massive rates of interest - sometimes up to 6,000%.

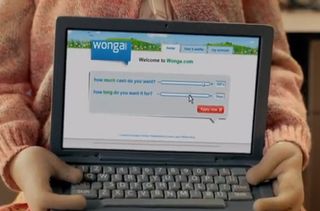

If you borrowed £200 from the Uk's biggest payday lender, Wonga (who charge 5,853% APR), for 24 days - you would have pay back £254.82.

Why is the industry/media so worried about people using them?

Payday loan companies been heavily slammed by the media, government, charities and even the head of the Church of England over their high interest charges.

Charities have also accused payday lenders of pushing customers into a spiral of debt because of the way they operate - some let people roll over loans, increasing the amount they owe, a number of times.

GoodtoKnow Newsletter

Parenting advice, hot topics, best buys and family finance tips delivered straight to your inbox.

They also say that people who borrow from payday loan companies end up taking out loans from multiple lenders because they cant afford to pay them off.

What should you use a payday loan for?

As an absolute last resort. For example, you've run out of money and your car needs to be repaired in order for you to get to work.

Wonga's co-founder Errol Damelin once told ITV news: 'This is not about people on breadlines being desperate...this is about us serving customers who want to take a loan and know they can pay it back in 3 days - that is in the same way that they want to buy one song on iTunes.'

We tend to disagree. Borrowing money is not the same as buying one song on iTunes.

You should never use a payday loan for nights out, concert or sport tickets, new clothes or treats, such as a new album.

The Money Advice Service says in its guide to payday loans, 'In reality, all you're doing is paying a small fortune to borrow money for something you can't afford.'

What to do if you're in debt

If you're considering taking out a payday loan or are having problems with debt then don't worry - there is help at hand.

Speak to a debt proffesional for free - try Citizens Advice, National Debtline or StepChange Debt Charity.

We've also got some good tips in our guide to getting out of debt.

Have you ever taken a payday loan out? Please tell us about in the comment box below.

Where to next? - How to get out of debt - 'I spent £1,000 on fake Justin Bieber tickets' - Free childcare for two-year-olds to double

-

Compromising may be killing your relationship - here are 5 ways to reach healthy compromises, according to relationship expert

Compromising may be killing your relationship - here are 5 ways to reach healthy compromises, according to relationship expertCompromising isn't always the best way to keep the peace in a relationship

By Charlie Elizabeth Culverhouse Published

-

Best interactive pets for kids: 15 gift ideas for children of all ages

Best interactive pets for kids: 15 gift ideas for children of all agesFrom puppies to axolotls, take a look at our selection of the best interactive pets you can buy that are sure to be a hit with little animal lovers

By Sarah Handley Published